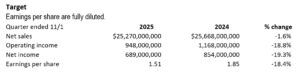

MONROE, Mich. — Modest growth in La-Z-Boy Inc.‘s retail and wholesale segments was offset by lower delivered volume in the Joybird business, leading to flat-ish results on the top line for the second quarter ended Oct. 25.

Total retail sales of $522 million were up 0.3% from the prior-year period.

Within the company’s retail segment, which consists of company-owned La-Z-Boy stores, sales grew 4%, with delivered sales increasing slightly to $222 million. Written same-store sales dipped 2%, but that marked a sequential improvement in written same-store sales trends over the last two quarters as lower traffic and conversion were partially offset by higher average ticket and design sales.

See also: Linz, Sundy take new roles in La-Z-Boy leadership realignment

In La-Z-Boy’s wholesale segment, sales rose 2% to $369 million, spurred by grown in the company’s core North America La-Z-Boy branded business. Joybird’s sales fell 10% to $35 million on lower delivered volume.

The company’s operating margin was 6.9% on a GAAP basis, and diluted earnings per share totaled 71 cents. La-Z-Boy generated $50 million in operating cash flow for the quarter, triple last year’s Q2.

During the quarter La-Z-Boy also completed its 15-store acquisition in the Southeast region, which it expects to bring in $80 million in annual retail sales — half of which will be net to enterprise. In addition, the company announced the planned exit of non-core businesses (Kincaid and American Drew case goods and Kincaid upholstery), the proposed closure of its UK manufacturing facility and a strategic realignment of its leadership.

Those initiatives combined are expected to reduce sales by approximately $30 million, net, and increase margins by 75-100 bps.

President and CEO Melinda D. Whittington noted that by producing approximately 90% of its finished goods through its North American manufacturing base, “we are successfully navigating the current trade and tariff volatility.”

Looking ahead, La-Z-Boy expects fiscal third quarter sales to land in the range of $525 million to $545 million, which would represent grow of 1% to 4% compared with last year’s Q3. Adjusted operating margin is expected to be in the range of 5.0% to 6.5%.