Minneapolis – Target executives outlined the company’s priorities as it seeks to get sales growing again under a new CEO. The first is merchandising.

In home, that means new leadership as part of the retailer’s broader merchandising overhaul.

“Home has been a challenged business,” said Rick Gomez, EVP and chief commercial officer. “We’re making changes to the product to elevate the style but we are also changing the store experience to facilitate discovery.”

Home will be part of a new remodel that makes key changes to the store layout – the biggest reworking of the store pad Target has made in 10 years, he said. The company will also reinvent its Threshold brand, which has been a staple in the home department since its introduction in September 2012.

During this morning’s Q3 investor call, incoming CEO Michael Fiddelke said Target is expanding its use of AI within each product category to provide merchants with real-time data about what consumers are responding to and what’s trending on social media in order to boost speed to market.

“We are a design-led company and that starts with our authority in merchandising,” said Fiddelke. “We believe in offering an assortment that is distinctly ours.”

The company recently eliminated about 1,800 headquarters positions (8% of total staff) as part of its effort to streamline the merchandising process and to make clear who “owns” merchandising decisions, he added.

In the meantime, Target’s major discretionary pillars – apparel and home – continue to drag. Apparel comp was down 10% in Q3. The company did not share comp results for home.

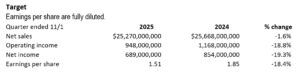

Total sales were down 1.5% to $25.3 billion for the period ended Nov. 1. Comp sales decreased 2.7% in the third quarter, reflecting a same-store sales decline of 3.8%, partially offset by comparable digital sales growth of 2.4%.

The company plans to share more details about its plans during its 2026 investor day event in March, executives said. In the immediate term, Target is keeping expectations in check for Q4 – reiterating guidance for a low-single digit decline in sales.