Nobody can accurately predict the likely outcome of any tentative US-brokered peace negotiations with Russian president Vladimir Putin. But one thing is for sure: when the war does finally end, there will be a lot of clearing up to be done.

It is hardly surprising therefore that Ukraine is already positioning itself to attract major Western contractors for what is expected to become one of Europe’s largest reconstruction programmes in decades.

With civil infrastructure, energy systems and industrial facilities badly damaged by Russia’s invasion, Kyiv is preparing for long-term rebuilding and is sharpening its pitch to UK and EU firms.

Joint assessments by the World Bank, the European Commission and the Ukrainian government put the scale of required reconstruction at around $524bn. Prime minister Denys Shmyhal has cited a similar figure of €500bn and says a significant portion of the funding is expected to come through Western investment, alongside possible use of frozen Russian assets and direct government aid.

Although the UK is one of Ukraine’s strongest political and military supporters, British contractors have so far shown limited interest in early-stage reconstruction work. Several EU firms have already begun evaluating opportunities, while UK companies remain cautious. Analysts say this is partly because the flagship 100-year UK–Ukraine partnership agreement signed in January 2025 is weighted heavily toward defence cooperation. The agreement aims to strengthen security ties, boost economic collaboration and ensure enduring support for Ukraine’s sovereignty. Commercial engagement is a secondary aspect.

One of the clearest examples of UK–Ukraine defence cooperation is Thales’ recent contract to supply 5,000 air-defence missiles to Kyiv. According to the company, production of the weapons at its Belfast factory will create 200 jobs directly, with a further 700 jobs across the supply chain.

Civil construction involvement from the UK has so far been much more limited. That might begin to shift after a recent meeting in London between Ukraine’s economy minister Oleksiy Sobolev and UK business secretary Chris Bryant, which resulted in an agreement to expand financial support mechanisms for Ukrainian entrepreneurs. Observers in Kyiv believe this could encourage more British firms to look seriously at opportunities from 2026 onwards.

The UK government continues to provide direct assistance. At the end of 2024, London allocated an extra £35m to Ukraine for energy infrastructure repairs and humanitarian support, with £20m earmarked specifically to cover the country’s emergency energy needs and repair damaged power grids, as well as providing measures to protect them. Meanwhile, Ukraine’s minister for communities and territories, Olena Shkrum, says more than 25 major investment funds listed in London have shown early interest in participating in recovery projects.

“The UK has shown significant support and a willingness to further develop cooperation to support recovery. British businesses are ready to participate in our projects and invest in Ukraine now. This was discussed, in particular, during a meeting with more than 25 of the largest investment funds and corporations listed on the London Stock Exchange,” said Shkrum.

Industry sentiment in the UK may also be shifting for domestic reasons. According to the National Federation of Builders (NFB), an increasing number of UK contractors are evaluating projects abroad as domestic regulation and planning constraints intensify.

Rico Wojtulewicz, NFB’s head of policy and market insight, says: “It is surprising how many contractors deliver projects abroad and lately we have seen some members expand into the Republic of Ireland to escape the UK’s planning and regulatory landscape. The continuation of policies which make projects risky, unviable, and low profit will certainly encourage more companies to explore opportunities abroad and perhaps speak to the commonwealth nations that have been courting industry in recent years.”

Wojtulewicz believes Ukraine’s civil engineering and energy sectors could prove particularly attractive once conditions stabilise:

“When the war eventually ends and tier-one contractors start mobilising to explore work pipelines, the landscape for construction projects will become clearer for the wider construction industry. Civil engineering and energy infrastructure businesses are most likely to have the flexibility and skills to mobilise quickly and I would expect to see specialist contractors, particularly those working on high security projects, to follow soon after.”

Major UK construction firms remain tight-lipped, however. Bowmer & Kirkland, for example, told The Construction Index that it is focusing on domestic workload and declined further comment; Skanska UK said it has not ruled out future involvement but has no current plans. And German-owned Hochtief also declined to give a view.

Nevertheless, several international contractors are monitoring the situation but expect strong competition from Ukrainian firms. A spokesperson for Vinci was blunt: “Ukrainians have very good construction companies and do not need us. What they need most is funding.”

Ukrainian media reports suggest that international contractors, if and when they do enter the market, will first be directed toward rebuilding social infrastructure — schools, hospitals and municipal buildings — before moving into heavier industrial and energy projects. EU companies, particularly from the Netherlands, are already in talks. The Dutch government has pledged €300m over the next two years for Ukrainian reconstruction, with plans under discussion for Dutch contractor involvement in a new extension to the Children’s Hospital in Lviv starting as early as next year.

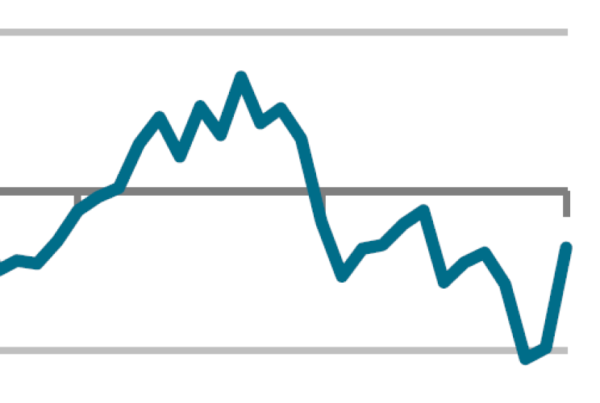

Despite the continuing bombardment of energy and industrial facilities, construction activity in western Ukraine has rebounded sharply. Analysis by Kyiv-based think-tank and consultancy GMK Center shows that total construction output in 2024 exceeded pre-war 2021 levels by around 25% across residential, industrial and warehouse development. With the shift of economic activity away from frontline regions, the western oblasts of Lviv, Khmelnytskyi, Zhytomyr, Vinnytsia and the wider Kyiv region have become key hubs for new logistics, hotel and industrial projects. Hotel construction alone was 36% higher in 2024 than before the war.

“Western Ukraine has now become a major construction site,” says Vitaliy Prytula, director of Eurometall, one of Ukraine’s leading distributors of rolled steel and metal products. “We’re seeing active hotel and recreational construction in the Carpathian region as well as industrial construction activity for agricultural and food enterprises, such as grain elevators and other food processing facilities”.

Industrial and warehouse construction, which fell to 686,000m² in 2022, recovered to 987,000m² in 2024 — up 16% year-on-year. Output in this sector is expected to surpass one million square metres in 2025. A growing share of new factories is geared towards supplying EU manufacturers, particularly in automotive components, cable assemblies and electrical goods.

Large foreign investors have recently increased their presence. Kronospan, the Austrian manufacturer of wood-based panel products, has opened a €200m OSB production line in Rivne and French materials giant Saint-Gobain has commissioned a dry-mix construction plant in Ivano-Frankivsk following an €11m (£9.7m) investment. All are located in western Ukraine, which remains comparatively insulated from frontline fighting.

By contrast, construction activity in the occupied or contested eastern regions of Donetsk, Luhansk, Kharkiv and Zaporizhia – once the industrial heartland of both Ukraine and, historically, the USSR – continues to decline sharply.

Reconstruction funding is still being shaped. One of the main vehicles will be the EU’s Ukraine Reconstruction Fund, a private equity structure backed by Italy, Germany, France and the European Investment Bank. It will launch with €220m in capital, with a further €500m expected in 2026.

The Ukrainian government hopes the availability of predictable funding streams will give Western contractors enough confidence to commit to long-term work in what could become Europe’s biggest construction market for decades.

UKRAINE RECONSTRUCTION IN NUMBERS

Overall reconstruction cost:

- £394bn (US$524bn) according to the World Bank/European Commission estimate. The Ukraine government puts the likely cost at £439bn (€500bn)

UK financial support:

- £35m additional funding announced late 2024

- £20m earmarked specifically for emergency energy repairs and grid protection

- 100-year UK–Ukraine partnership agreement ratified in 2025, covering defence, security and economic cooperation

EU contributions:

- €300m pledged by the Netherlands for reconstruction over two years

- €220m initial capital for new EU-backed Ukraine Reconstruction Fund

- Further €500m expected by 2026

Industrial and commercial construction trends:

- Industrial/warehouse commissioning up 16% in 2024 (to 987,000 m²)

- Activity expected to exceed 1m m² in 2025

- Hotel construction in 2024 up 36% vs pre-war 2021

- Total area under construction now 25% above 2021 levels

Major recent foreign investments:

- €200m — Kronospan OSB line, Rivne region

- $30m — Philip Morris factory, Lviv region

- €11m+ — Saint-Gobain dry-mix plant, Ivano-Frankivsk

Population and geographic context:

- Ukraine population: approx. 40 million

- Strongest construction growth: Lviv, Kyiv, Khmelnytskyi, Zhytomyr, Vinnytsia

- Severely impacted regions: Donetsk, Luhansk, Kharkiv, Zaporizhia

Got a story? Email [email protected]